In the land of the free and the home of the brave, racial disparities continue to linger in the shadows of society. One such area of contention lies within homeowner tax subsidies, where stubborn inequities persist despite efforts to level the playing field. As we delve into the complex web of policies and practices that perpetuate these disparities, it becomes clear that the time has come to shine a light on this pressing issue and push for meaningful change. Join us on a journey as we explore the challenges and opportunities in fighting racial disparities in homeowner tax subsidies.

Identifying disparities in homeowner tax subsidies

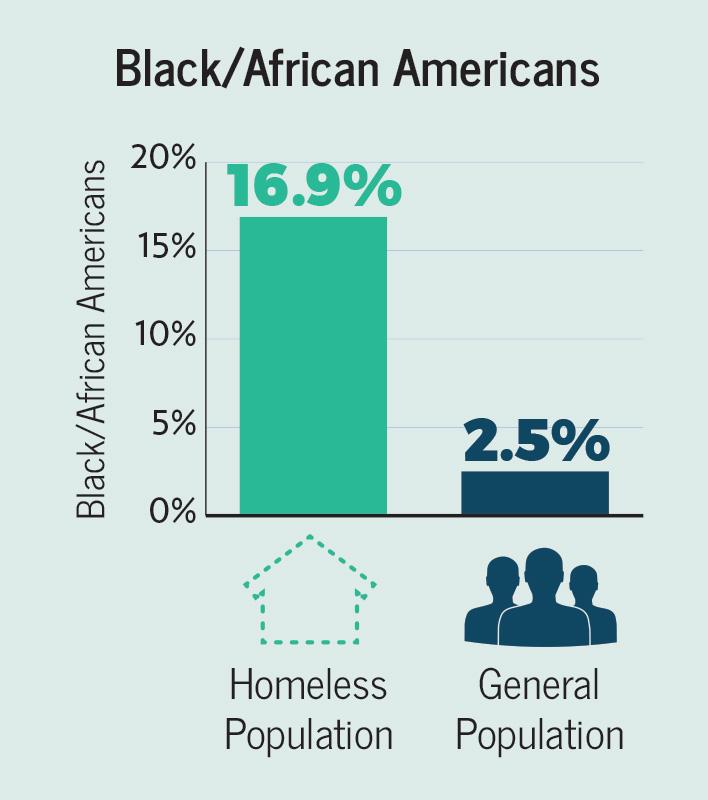

Understanding the root of the issue is crucial in addressing the disparities in homeowner tax subsidies. By analyzing data and conducting research, we can pinpoint where the discrepancies lie and develop targeted solutions to bridge the gap. Identifying the specific factors contributing to these disparities, whether it be income levels, geographical location, or systemic biases, is the first step towards creating a more equitable system.

**Collaboration and community involvement are key in the fight against racial disparities in homeowner tax subsidies.** Engaging with local organizations, government agencies, and advocacy groups can help amplify our efforts and bring about meaningful change. By working together, we can advocate for policy reforms, raise awareness about the issue, and ultimately create a more inclusive and fair tax subsidy system for all homeowners.

Addressing systemic inequalities in tax policies

It is crucial to address the systemic inequalities present in tax policies, especially when it comes to homeowner tax subsidies. One area that requires immediate attention is the persistent racial disparities that exist within these subsidies. By examining and challenging the current structures in place, we can work towards creating a more equitable system that benefits all homeowners, regardless of their race or background.

One way to combat these racial disparities is to implement targeted reforms that specifically address the issues faced by minority homeowners. This could include providing additional financial support or incentives for low-income families, creating more transparent application processes, and offering educational resources to help homeowners navigate the complexities of the tax system. By taking proactive steps to level the playing field, we can begin to make meaningful progress towards achieving true equity in homeowner tax subsidies.

Recommendations for creating a more equitable system

When addressing stubborn racial disparities in homeowner tax subsidies, it is crucial to implement proactive measures that promote fairness and inclusivity. One key recommendation is to establish clear criteria for eligibility based on income levels rather than race. This way, individuals from disadvantaged communities will have equal access to tax subsidies regardless of their background.

Additionally, providing education and resources to support homeownership among marginalized groups is essential. By offering financial literacy programs and affordable housing options, we can empower underserved communities to build generational wealth and break the cycle of inequality. It is also crucial to diversify decision-making bodies responsible for allocating tax subsidies to ensure that the needs of all communities are represented. Together, these recommendations can help create a more equitable system that promotes fairness and opportunity for all.

Taking action to reduce racial disparities in homeowner tax subsidies

Recent data has shed light on the stark racial disparities present in homeowner tax subsidies across the country. While these subsidies are meant to provide relief to homeowners, they have inadvertently perpetuated inequality for marginalized communities. It is crucial that we take proactive steps to address these disparities and work towards creating a more equitable system for all homeowners.

One way to combat these racial disparities is by implementing targeted initiatives that specifically aim to support minority homeowners. This could include providing financial education and assistance to help navigate the complexities of tax subsidies, as well as creating transparency in the application process. By actively working to level the playing field, we can begin to chip away at the systemic barriers that have unfairly disadvantaged certain groups for far too long.

Insights and Conclusions

In conclusion, the fight against stubborn racial disparities in homeowner tax subsidies is a necessary and ongoing battle. By acknowledging and addressing the systemic issues that contribute to these disparities, we can work towards a more equitable system for all homeowners. Through advocacy, education, and policy changes, we have the power to create a future where every homeowner has access to the support they need to thrive.Together, we can make a difference. Let’s continue to push for change and ensure that everyone has a fair chance at homeownership.