In the world of financial oversight, attention to detail is key. Recently, the Public Company Accounting Oversight Board (PCAOB) uncovered deficiencies in auditor evaluations that have raised concerns within the industry. Let’s delve into the findings and implications of these crucial discoveries.

PCAOB Report Reveals Widespread Auditor Evaluation Deficiencies

The recent PCAOB report has shed light on the alarming rate of deficiencies in auditor evaluations across various firms. The findings reveal a pervasive issue within the auditing industry, highlighting the need for improved practices and standards.

Among the key points outlined in the report are:

- Inadequate documentation of auditor assessments

- Lack of independence in the evaluation process

- Failure to adequately consider potential conflicts of interest

Lack of Independence and Objectivity Identified in Many Audit Firms

Upon conducting a thorough evaluation of various audit firms, the Public Company Accounting Oversight Board (PCAOB) has unearthed notable deficiencies in the independence and objectivity of many auditors. These findings have raised concerns regarding the credibility and reliability of audit reports issued by these firms. The lack of independence and objectivity compromises the integrity of the auditing process and undermines the trust stakeholders have in financial statements.

The PCAOB’s assessment revealed that audit firms were frequently found to be compromised by conflicts of interest, leading to biased assessments and compromised objectivity. This trend highlights the need for stricter regulatory oversight and enforcement to ensure that auditors adhere to professional standards and maintain the necessary independence and objectivity in their evaluations. Moving forward, it is imperative for audit firms to prioritize these fundamental principles to uphold the integrity of financial reporting and restore trust in the auditing profession.

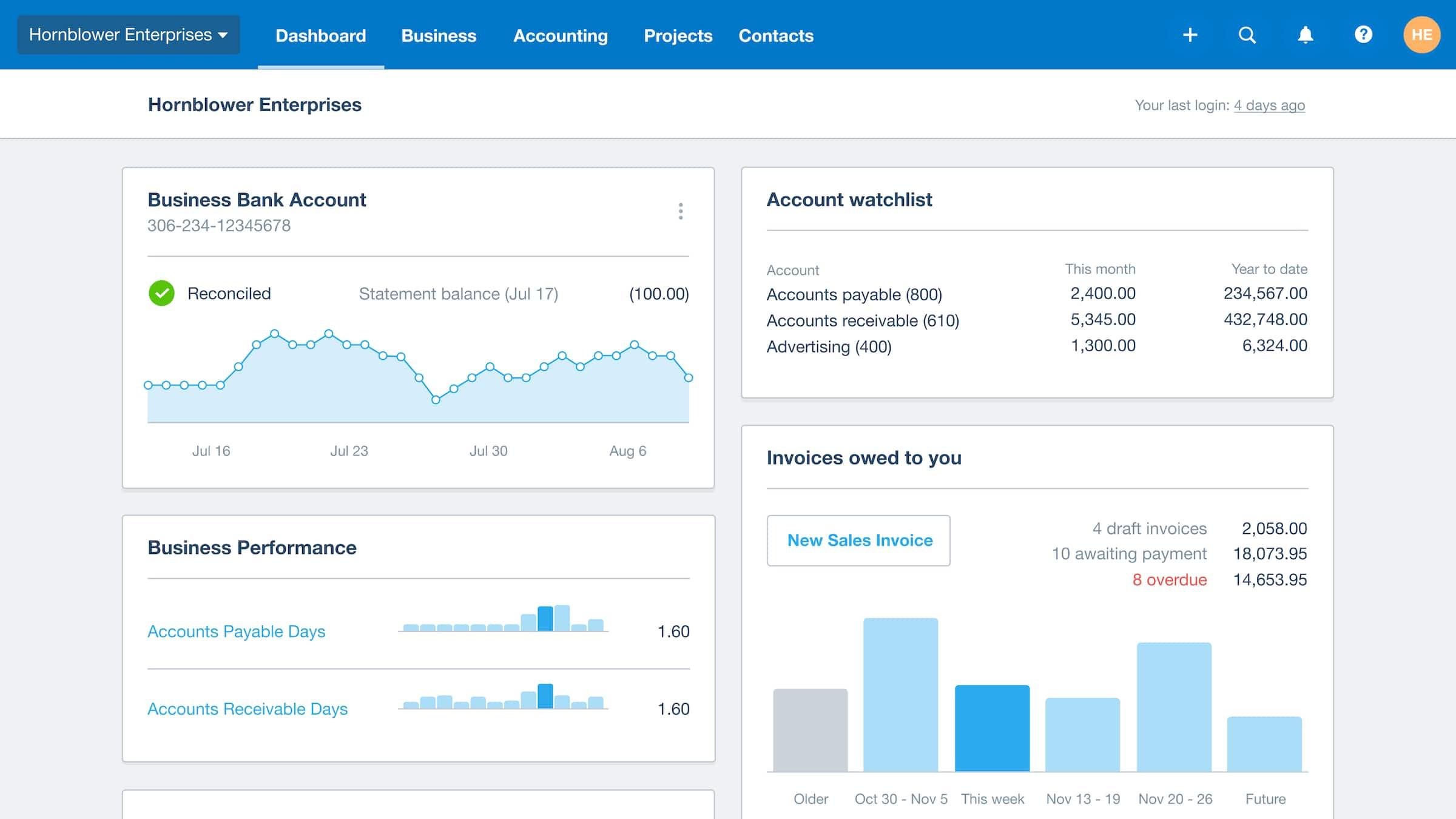

Need for Improved Oversight and Training for Audit Committees

In a recent report, the PCAOB highlighted several deficiencies in auditor evaluations, emphasizing the . The findings revealed that many audit committees were not adequately evaluating the performance of their auditors, leading to potential risks and shortcomings in the audit process. This highlights the importance of enhancing the oversight and training provided to audit committees to ensure they have the proper tools and knowledge to effectively evaluate auditors.

One way to address these deficiencies is to implement more structured training programs for audit committee members. Providing members with comprehensive training on auditing standards, best practices, and regulatory requirements can help them better understand their roles and responsibilities. Additionally, establishing clear guidelines and procedures for evaluating auditors can ensure consistency and thoroughness in the evaluation process. By enhancing oversight and training for audit committees, organizations can strengthen their audit processes and improve the overall quality of financial reporting.

Recommendations for Enhancing Auditor Evaluation Processes and Compliance

During a recent inspection, the PCAOB identified several deficiencies in auditor evaluation processes and compliance. To address these issues, it is recommended that audit firms implement the following enhancements:

- Enhance documentation: Ensure that all aspects of the auditor evaluation process are well-documented, including criteria used for evaluation, methodology, and results.

- Improve oversight: Establish clear lines of responsibility for overseeing auditor evaluations and compliance, and provide regular training to staff on best practices.

- Enhance communication: Foster open communication between auditors, audit committees, and management to ensure that all parties are aware of expectations and responsibilities.

By implementing these recommendations, audit firms can enhance their auditor evaluation processes and ensure compliance with regulatory standards, ultimately improving the quality of their audits and the trust of stakeholders.

The Way Forward

In conclusion, the PCAOB’s findings highlight the importance of accurate and thorough auditor evaluations in maintaining transparency and trust in the financial reporting process. By addressing these deficiencies, auditors can enhance their performance and ensure the reliability of the information they provide to stakeholders. Moving forward, it is crucial for audit firms to take proactive measures to strengthen their evaluation processes and uphold the integrity of the profession. Only through vigilance and diligence can we continue to uphold the highest standards of excellence in auditing. Thank you for reading.