In the heart of historic Massachusetts, a bold proposal is being considered to address the pressing issue of affordable housing. State officials are currently exploring the idea of implementing a mansion tax, a potential solution that could help fund much-needed housing initiatives. As the cost of living continues to rise, the concept of taxing luxury properties to support those in need is sparking both debate and curiosity. Let’s delve into the potential impact and complexities of this novel strategy.

Exploring the Concept of a Mansion Tax in Massachusetts

Massachusetts officials are considering the implementation of a mansion tax as a potential solution to fund affordable housing initiatives across the state. The proposed tax would target homeowners with properties valued at over a certain threshold, with the revenue generated being allocated towards programs aimed at increasing access to affordable housing for low-income residents.

Proponents of the mansion tax argue that it would help address the growing wealth gap in Massachusetts and provide much-needed funding for housing assistance programs. By targeting those with high-value properties, the tax aims to ensure that wealthier individuals contribute their fair share towards addressing the affordable housing crisis. However, critics raise concerns about the potential impact on property owners and the real estate market, highlighting the need for careful consideration and planning before implementing such a tax.

Funding Affordable Housing Initiatives Through Taxation

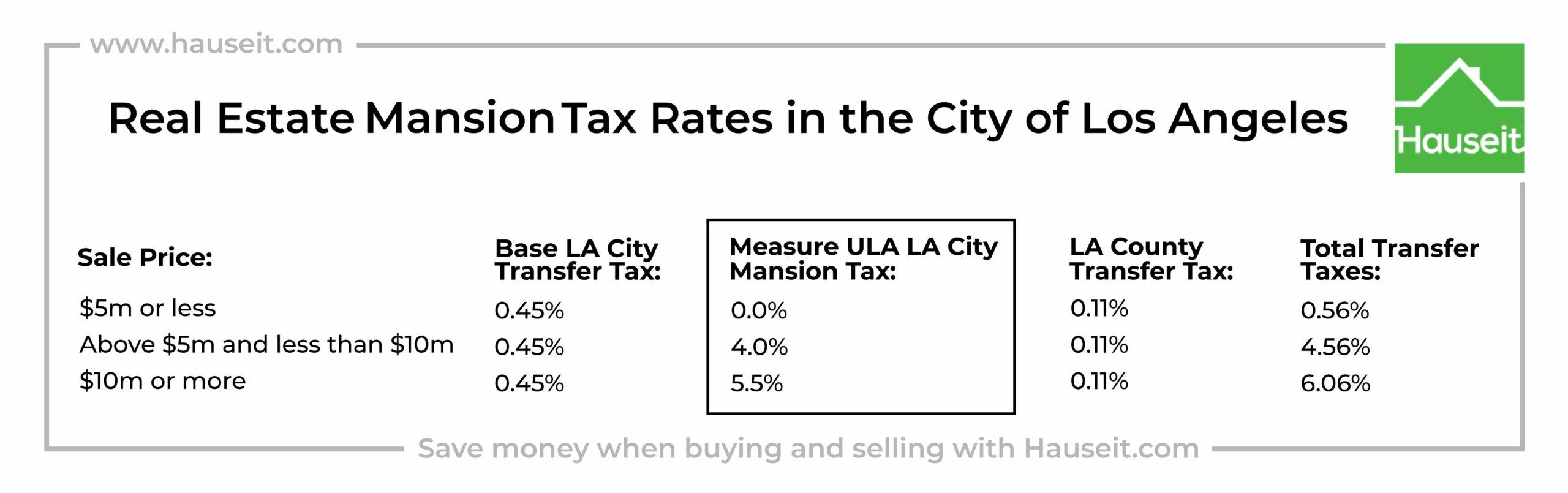

One innovative proposal being considered in Massachusetts is the implementation of a mansion tax to fund affordable housing initiatives. This tax would target the wealthiest property owners in the state, specifically those who own properties valued at over a certain threshold. By assessing a higher tax rate on these luxury properties, the state aims to generate additional revenue to support the creation of more affordable housing units for low and moderate-income residents.

Advocates of the mansion tax argue that it is a fair and equitable way to fund affordable housing, as it places the burden on those who can afford it the most. This approach also helps to address the growing wealth gap in the state by redistributing funds from the wealthiest individuals to those in need of housing assistance. Additionally, by utilizing taxation as a funding mechanism, Massachusetts can ensure a consistent and sustainable revenue stream for affordable housing projects in the long term.

Challenges and Opportunities of Implementing a Mansion Tax

Implementing a mansion tax in Massachusetts presents both challenges and opportunities for the state. On one hand, taxing high-value properties can generate significant revenue that can be used to fund affordable housing initiatives and address the housing crisis in the state. This additional source of income can help create more affordable housing units, provide housing assistance programs, and support community development projects.

However, there are also challenges that come with implementing a mansion tax. Some of these challenges include:

- Resistance from wealthy homeowners: High-income homeowners may push back against the mansion tax, leading to potential legal battles and opposition.

- Economic impact: There is a concern that a mansion tax could deter wealthy individuals from residing in Massachusetts, potentially impacting the housing market and overall economy.

- Enforcement and administration: Proper implementation and enforcement of the mansion tax regulations will require resources and monitoring to ensure compliance.

Recommendations for Ensuring Fairness and Effectiveness in Taxing Luxury Properties

When it comes to taxing luxury properties in Massachusetts, there are several key recommendations that can help ensure fairness and effectiveness. One approach that has been gaining traction is the implementation of a mansion tax, which would target high-value properties and use the revenue to fund affordable housing initiatives. This proposal has the potential to address both the issue of income inequality and the lack of affordable housing in the state.

Another recommendation for taxing luxury properties is to introduce a progressive tax system that takes into account the value of the property. By implementing a tiered tax structure, with higher rates for properties above a certain threshold, the burden can be placed more heavily on those who can afford it. This approach not only promotes fairness in the tax system but also ensures that luxury property owners contribute their fair share to the community.

Final Thoughts

As Massachusetts explores new ways to address its affordable housing crisis, the proposal for a mansion tax has sparked a debate on how best to allocate resources and promote economic equity. Whether this tax ultimately becomes law or not, one thing is clear: the need for affordable housing solutions in the state remains urgent. As policymakers and advocates continue to seek innovative funding mechanisms, let us hope that all residents of Massachusetts can find a place to call home.