In the shadows of the workforce, a haunting presence lurks – the “ghost employers” that evade their tax obligations and vanish into thin air. The IRS has set its sights on these elusive entities, determined to uncover their schemes and bring them to light. Join us as we delve into the murky world of tax fraud and explore how the IRS plans to hunt down these phantom employers.

Identifying ‘Ghost Employers’ in IRS Investigations

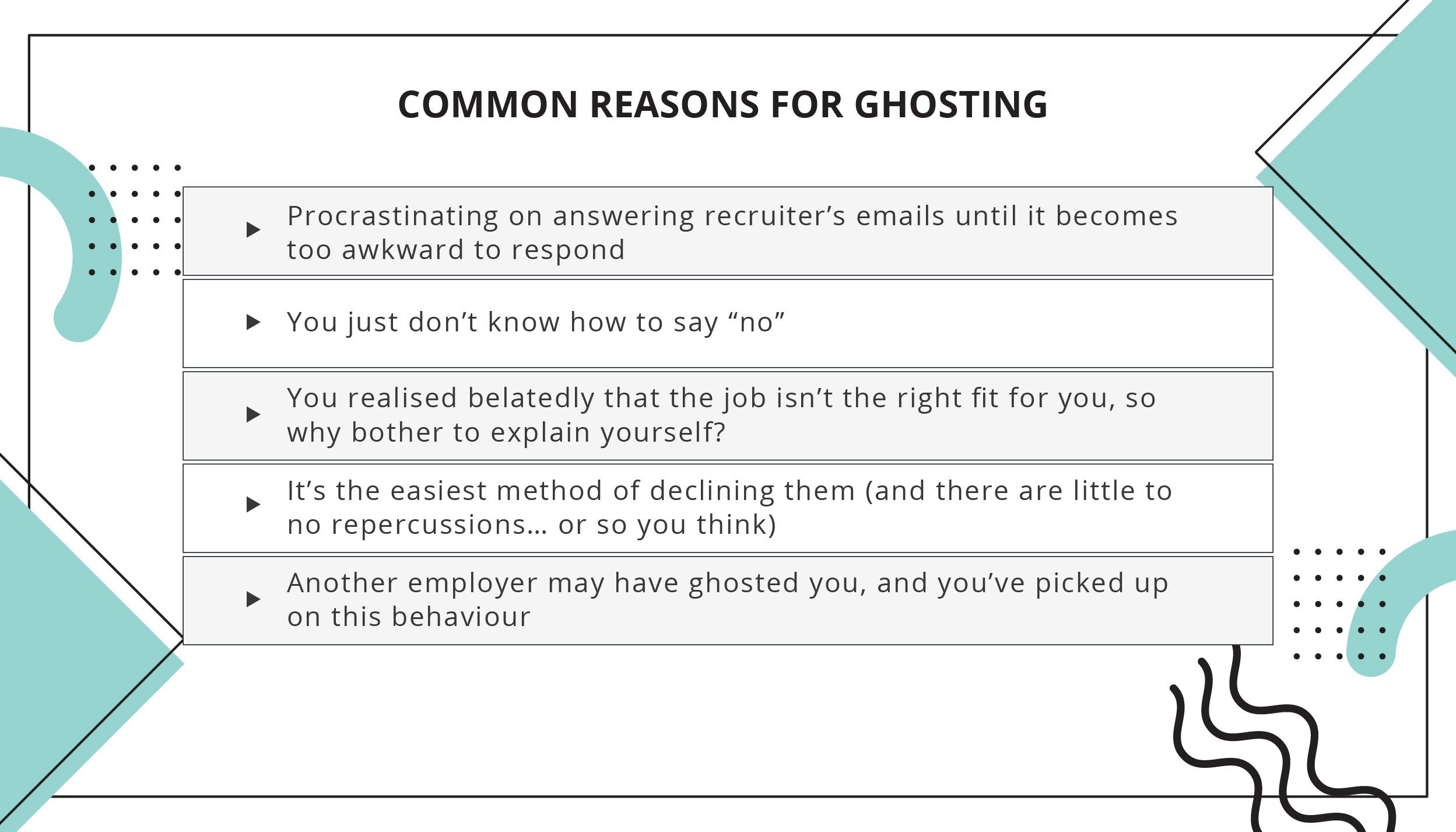

In IRS investigations, one of the key focuses is on identifying ‘ghost employers’ who attempt to evade taxes by misclassifying employees or underreporting wages. These ghost employers often utilize tactics such as paying workers under the table, using fake or stolen identities, or creating shell companies to hide their true activities.

IRS agents rely on various methods to uncover these ghost employers, including conducting interviews with employees, reviewing financial records, and cross-referencing data with other government agencies. By identifying these fraudulent practices, the IRS aims to hold these employers accountable and ensure that all individuals and businesses pay their fair share of taxes.

Uncovering the Impact of Fraudulent Payroll Schemes

Reports from the IRS indicate a growing concern over the prevalence of ‘ghost employers’ engaging in fraudulent payroll schemes. These schemes involve fictitious companies created solely for the purpose of submitting false payroll information to the IRS in order to claim tax refunds. The impact of these fraudulent activities extends beyond just financial losses, as they also undermine the integrity of the payroll system and erode public trust.

By targeting ‘ghost employers,’ the IRS aims to crack down on these deceptive practices and hold perpetrators accountable. Through enhanced monitoring and enforcement efforts, the IRS hopes to deter individuals and entities from engaging in fraudulent payroll schemes and protect the integrity of the tax system. This proactive stance is essential in safeguarding taxpayer funds and upholding the fairness and transparency of payroll processes.

Strategies for Combatting Tax Evasion Through Phantom Employers

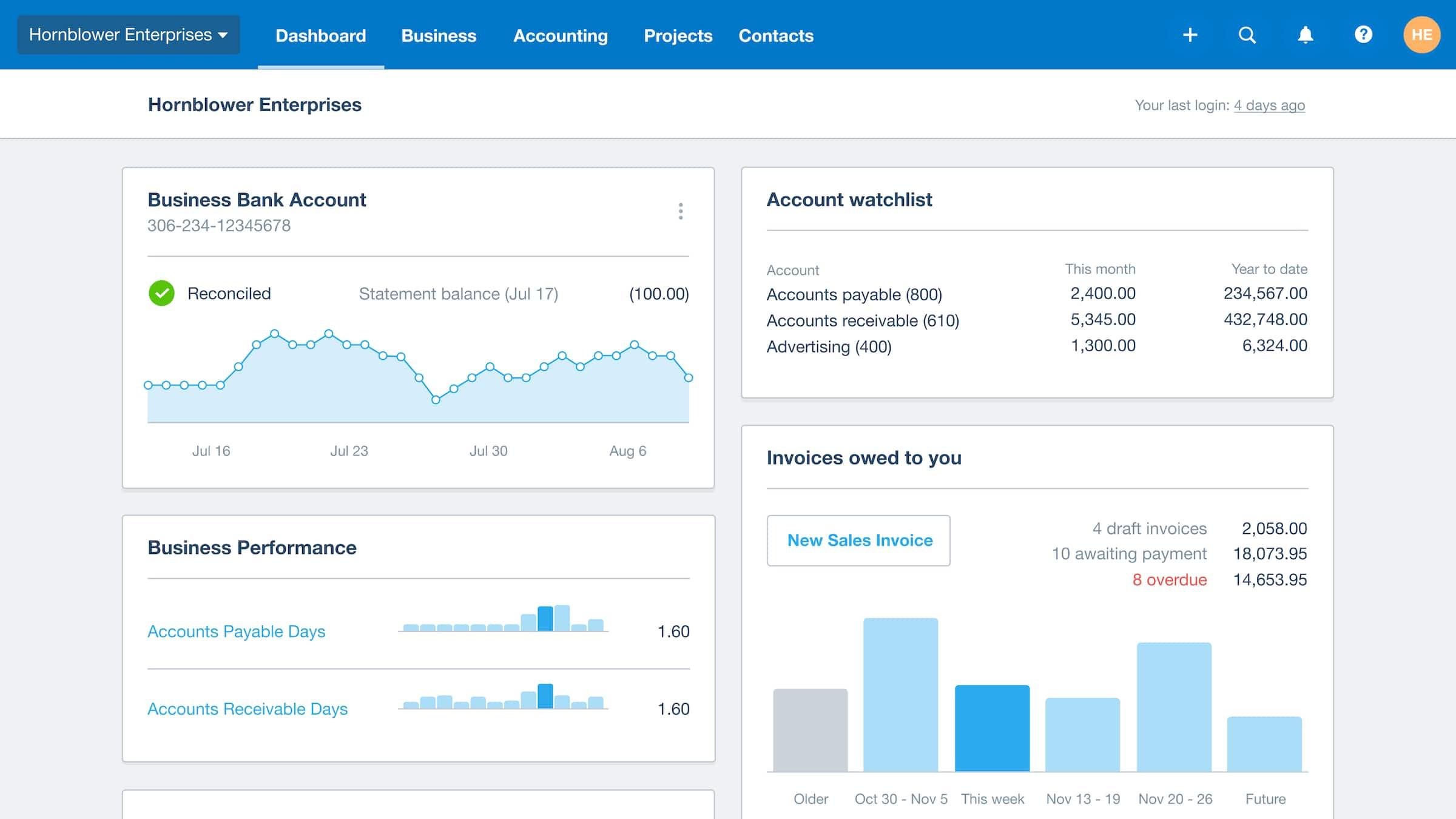

One effective strategy that the IRS is employing to combat tax evasion through phantom employers is increased data analysis and cross-referencing. By utilizing advanced technology and big data analytics, the IRS can identify patterns and anomalies in taxpayer information that may indicate the presence of ghost employers. This allows the IRS to target specific individuals or businesses for further investigation and enforcement actions.

Another key strategy is enhancing collaboration and information sharing between government agencies, financial institutions, and other stakeholders. By working together and sharing relevant data and intelligence, these entities can better track and uncover instances of tax evasion through phantom employers. This collaborative approach not only helps to identify fraudulent activities more efficiently but also allows for a more coordinated and effective response to combat this type of tax fraud.

Collaborating with Federal Agencies to Prevent Ghost Employment Fraud

Collaborating with federal agencies, such as the Internal Revenue Service (IRS), is crucial in the ongoing fight against ghost employment fraud. By working together, we can more effectively identify and prevent instances of individuals or companies falsely claiming employees who do not exist. The IRS has recently ramped up efforts to target these ‘ghost employers’, who engage in fraudulent practices to evade taxes and exploit government benefits.

Through data analysis and cooperative investigations, we can uncover instances of ghost employment fraud and hold perpetrators accountable. By sharing information and resources with federal agencies, we can strengthen our efforts to combat this type of financial crime. Together, we can protect the integrity of our labor market and ensure that taxpayer funds are not being misused by those seeking to exploit the system for personal gain.

Final Thoughts

In conclusion, the IRS’s crackdown on ‘ghost employers’ marks a significant step towards ensuring fair compliance with tax laws and protecting the integrity of the workforce. By identifying and penalizing these entities, the IRS is sending a clear message that tax evasion will not be tolerated. As the agency continues to refine its methods for detecting these elusive entities, businesses and individuals alike should take heed and ensure full transparency in their reporting practices. Together, we can work towards a more equitable and accountable economy for all. Thank you for reading.