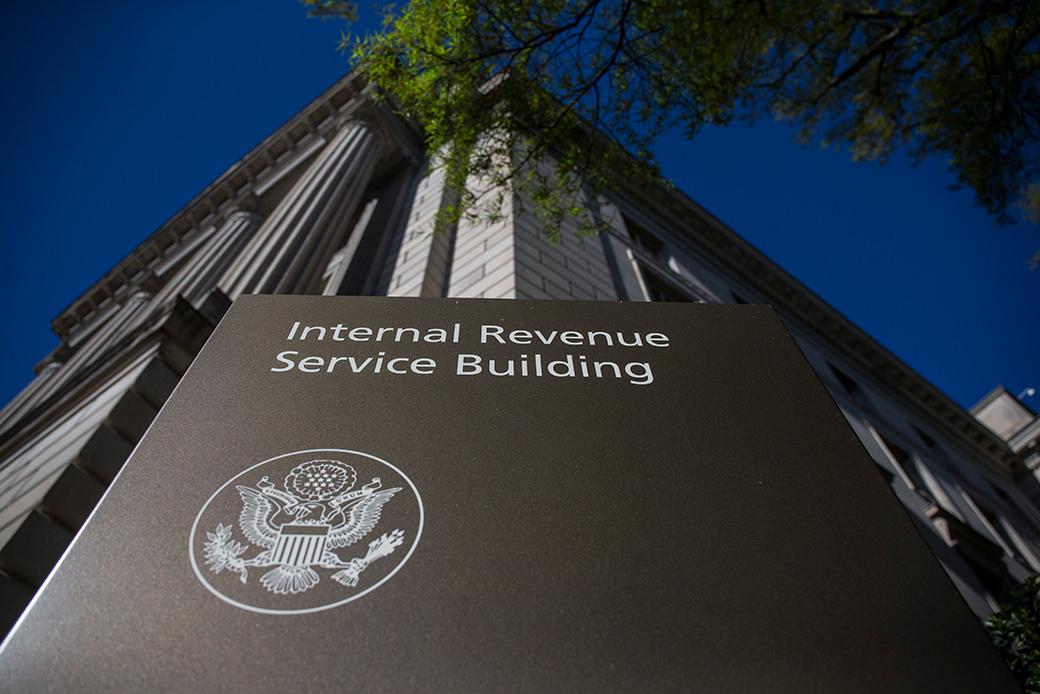

As the countdown to Tax Day looms closer, the IRS is gearing up for a deluge of last-minute returns from procrastinating filers. With the deadline rapidly approaching, the agency is bracing itself for the annual frenzy of taxpayers scrambling to meet their obligations before the clock strikes midnight. Let’s take a closer look at how the IRS is preparing for the flood of eleventh-hour submissions and what it means for both taxpayers and the agency.

IRS Expands Filing Options for Taxpayers

The IRS has recently announced that they are expanding filing options for taxpayers as they prepare for the flood of last-minute returns. This move comes as a relief for many taxpayers who may be scrambling to meet the fast-approaching deadline. With these new options, taxpayers can choose the method that best suits their needs, whether it be filing electronically, by mail, or through a tax professional.

Additionally, the IRS is offering extended hours at their taxpayer assistance centers to accommodate the increased demand in the final days leading up to the deadline. Taxpayers can also take advantage of online resources and tools provided by the IRS to help simplify the filing process. With these expanded options and resources, taxpayers can breathe a little easier as they work to meet their filing obligations before the deadline.

Key Deadlines to Keep in Mind for Last-Minute Filers

As the tax deadline quickly approaches, it’s important for last-minute filers to be aware of key deadlines to avoid potential penalties. Here are some important dates to keep in mind:

- April 15, 2022: This is the deadline to file your federal tax return and pay any taxes owed. It’s also the deadline to request an extension if you’re unable to file by this date.

- May 17, 2022: If you’ve filed for an extension, this is the deadline to submit your tax return. It’s important to note that this deadline only applies to filing your return, not to paying any taxes owed.

Tips for Ensuring Accuracy and Timeliness in Your Tax Return Submission

As the tax deadline looms, it’s crucial to ensure that your tax return submission is accurate and timely to avoid potential penalties or delays. To help you navigate this process smoothly, here are some essential tips to keep in mind:

- Organize Your Documents: Gather all necessary tax documents, such as W-2s, 1099s, and receipts, to ensure you have everything you need before filling out your return.

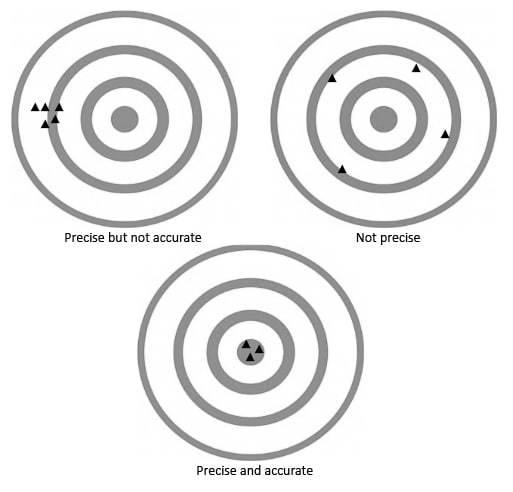

- Double-Check Your Information: Review your personal details, income, and deductions carefully to avoid errors that could lead to an audit or delays in processing.

- File Electronically: Submitting your tax return online is not only faster but also reduces the risk of mistakes that can occur when filling out paper forms.

| Tax Tip | Description |

|---|---|

| Use Direct Deposit | Opt for direct deposit to receive your refund faster and avoid postal delays. |

| Stay Informed | Stay up-to-date on tax law changes, deadlines, and requirements to ensure compliance. |

How the IRS is Streamlining Processes to Handle Increased Volume of Returns

The IRS is gearing up for a surge in last-minute tax returns as the deadline approaches. To handle the increased volume of returns, the agency has implemented several streamlined processes that aim to make the filing experience smoother for taxpayers. These improvements are designed to ensure that returns are processed efficiently and accurately, even during peak times.

One key initiative by the IRS is the expansion of electronic filing options, which allows taxpayers to submit their returns online, reducing the need for manual processing. Additionally, the agency has increased its focus on automation and digital tools to speed up processing times. By leveraging technology and enhancing workflow systems, the IRS is working to meet the high demand for tax returns while maintaining the highest standards of accuracy and security.

Closing Remarks

As the deadline for filing taxes approaches, the IRS is gearing up for a flood of last-minute returns. Whether you’ve procrastinated until the eleventh hour or simply need a little extra time to get your paperwork in order, rest assured that the IRS is ready to help. So gather your documents, double-check your math, and don’t forget to hit that submit button before time runs out. And remember, filing your taxes doesn’t have to be stressful – with a little planning and organization, you can breeze through tax season with ease. Happy filing!